Mumbai, July 21, 2021: The 29th Edition of Knight Frank-FICCI-NAREDCO Real Estate Sentiment Index Q2 2021 (April - June 2021) Survey cited that the future sentiments of real estate sector stakeholders remained optimistic in Q2 2021 despite the second COVID wave that struck during this period. Further, the stakeholders’ reaction to the second pandemic wave was not as severe as it was during the first wave as indicated by the relatively lesser drop in sentiment scores in Q2 2021. The Current Sentiment score has dropped from 57 in Q1 2021 to 35 in Q2 2021, but the drop is less intense than it was during the first COVID wave (Q2 2020) when the score had hit an all-time low of 22. The Future Sentiment score has inched down marginally from 57 in Q1 2021 to 56 in Q2 2021 continuing to remain in the optimistic zone. Here as well, the outlook of stakeholders reflects more resilience in Q2 2021 than in Q2 2020.

In terms of geography, the West zone saw the sharpest recovery in the Future Sentiment Score. This zone’s Future Sentiment score jumped from 53 in Q1 2021 to 60 in Q2 2021. With the resumption of economic activity, future sentiments (for the next six months) of stakeholders have remained in the optimistic zone, across most regions.

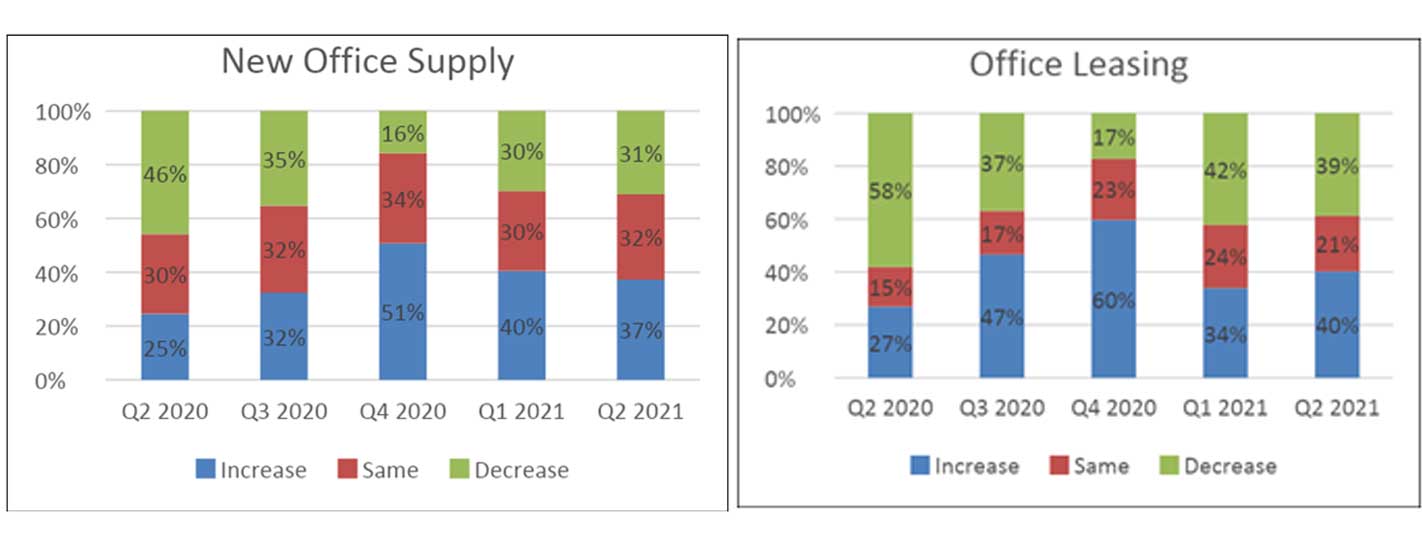

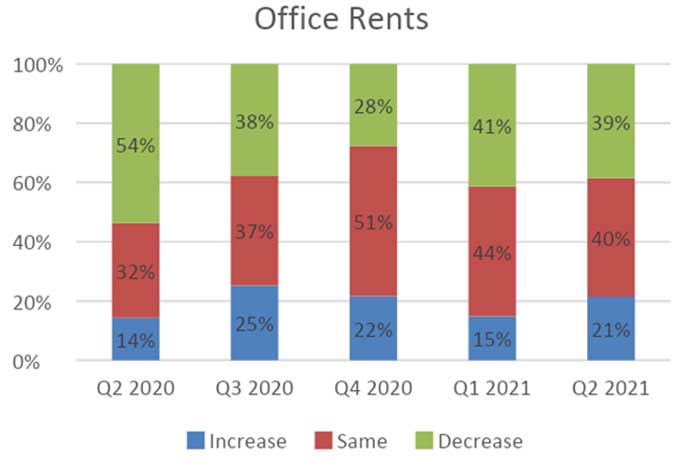

Stakeholder outlook on office market saw an improvement in Q2 2021 especially with respect to leasing activity. In Q2 2021, 40% of survey respondents were of the opinion that office leasing activity would increase over the next six months, up from 34% last quarter. Around 21% of the Q2 2021 survey respondents, up from 15% in Q1 2021, expects office rents to increase in the next six months while 40% expect rents to remain stable.

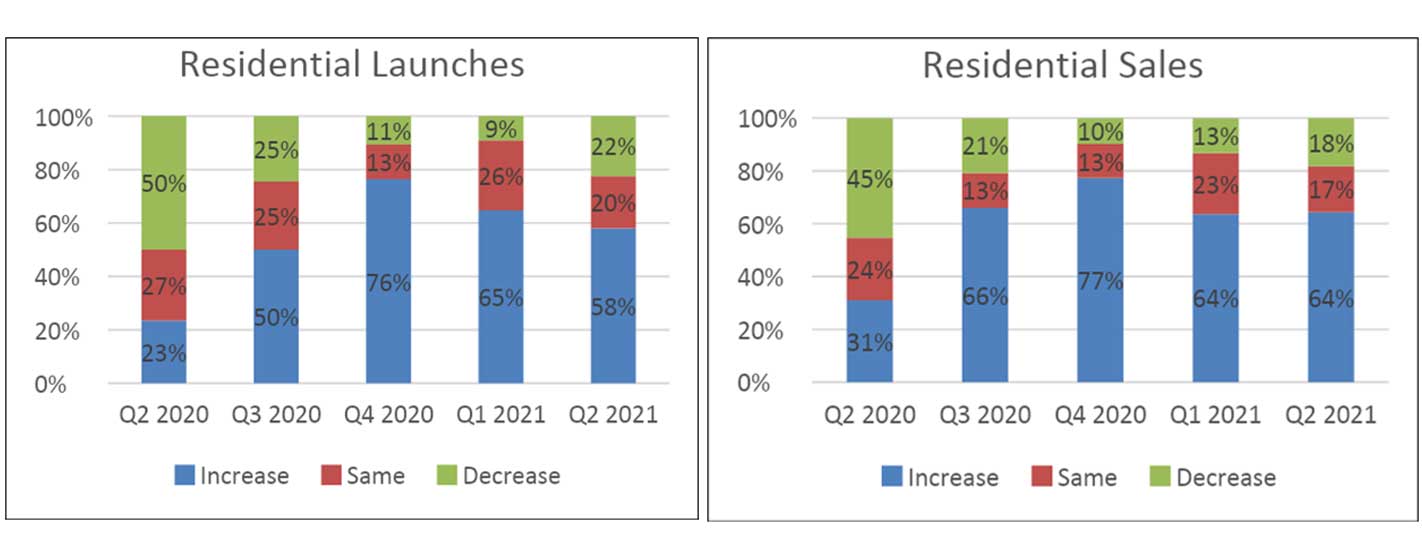

The optimism in residential market outlook has continued in Q2 2021. More than 50% of the Q2 2021 survey respondents continue to expect an increase in residential launches and sales in the coming six months.

On the macroeconomic front, more than 80% of the Q2 2021 survey respondents continue to have an optimistic outlook for the economy in the coming six months. While on the credit availability front, stakeholder outlook has improved in Q2 2021 with 46% respondents – up from 41% in Q1 2021 – expecting an increase in the coming six months.

Shishir Baijal, Chairman and Managing Director, Knight Frank India said, “The tragedy of the second wave of pandemic has pushed the overall industry sentiments down in the second quarter of 2021. However, our learning from the first wave, as well as a less stringent lockdown in the second wave, have equipped us well to mitigate the severity of the economic ramification, showing some level of positive outlook among the stakeholders when compared to the dead low sentiment score of 22 during the same period last year. The availability of vaccines, a robust vaccination programme, along with continued economic activities have been the primary reason for the optimistic future sentiment score, as compared to last year. The real estate sector is treading cautiously and acknowledge that there is latent demand for both office and residential sectors, albeit hindered by the prolonged pandemic.”

A score of above 50 indicates‘Optimism’ in sentiments, a score of 50 means the sentiment is ‘Same’ or ‘Neutral’, while a score below 50 indicates ‘Pessimism’.

ANNEXURE – 1

Overall Sentiment Score: Future Sentiment & Current Sentiment

Current Sentiment falters, Future outlook remains optimistic

Source: Knight Frank Research

Current Sentiment Score

- The Current Sentiment score dropped from 57 in Q1 2021 to 35 in Q2 2021, lowest in the last 12 months, moving into the pessimistic zone.

- However, the impact of the second COVID wave on stakeholder sentiments was less severe compared to the first wave. After the onset of the first wave of the pandemic, the Current Sentiment score had recorded an all-time low score of 22 in Q2 2020. A score of 35 in Q2 2021, although still in the pessimistic zone, is indicative of a more resilient market compared to the last time.

Future Sentiment Score

- The Future Sentiment score has inched down marginally from 57 in Q1 2021 to 56 in Q2 2021, indicating the continuity in the positive outlook of market stakeholders. Developments such as relaxations in lockdowns and restrictions, and the re-opening of offices since June 2021 have buoyed the stakeholder outlook for the coming six months.

- The impact of the second wave was lesser on the Future Sentiment score than on the Current Sentiment score reflecting the market’s preparedness to bounce back from the disruptions caused by the harrowing phases of the pandemic.

Zonal Future Sentiment Score

- Buoyed by the post-second wave resumption of economic activity, Future Sentiments of stakeholders for the next six months have remained in the optimistic zone across most regions.

- North zone’s Future Sentiment score has inched down marginally from 56 in Q1 2021 to 55 in Q2 2021, while for the South zone, the score has fallen from 63 in Q1 2021 to 57 in Q2 2021.

- The Future Sentiment score of the East region has entered the pessimistic zone with a fall from 53 in Q1 2021 to 48 in Q2 2021.

- In contradiction to such drops, West zone’s Future Sentiment score has climbed up this quarter, going from 53 in Q1 2021 to 60 in Q2 2021.

Future sentiments stay optimistic in most regions

Source: Knight Frank Research

Stakeholder Future Sentiment Score

- The future outlook of both developers and non-developers (non-developers include banks, financial institutions and PE funds) remains in the optimistic zone in Q2 2021, although there has been a significant fall in the sentiment score for non-developers.

- Developer sentiments have improved marginally from 54 in Q1 2021 to 56 in Q2 2021 indicative of their positive expectations from real estate business in the coming six months.

- Non-developer sentiments have fallen from 64 in Q1 2021 to 56 in Q2 2021 indicative of the caution in their outlook for the next six months.

Developer outlook improves, Non-developer outlook weakens

Source: Knight Frank Research; Note: Non-developers include banks, financial institutions and PE funds

Mr. Getamber Anand, Co-Chair, FICCI Real Estate Committee & Chairman and Managing Director, ATS Infrastructure Ltd said, “Despite the debilitating impact of a pandemic, the outlook of the sector is realty positive. This is reflected in a recent Knight Frank- FICCI-NAREDCO study, which reports the future sentiment score of 56 in Q2 2021 is an impressive rise from the Q2 2020 score of 41. There are several factors behind the growing positive sentiment. The nationwide vaccination drive has been a tremendous sentiment booster for the sector. The industry is also doing its bit by strengthening health infrastructure to support COVID patients and by initiating vaccination drives to inoculate over 2 crore construction workers. Furthermore, the sector is aggressively adopting 21st-century digital technologies to streamline the supply chain, attract home buyers, and most importantly, ensure business continuity. In the initial phase of 2021, we were gearing for a spirited turn-around, which was disrupted by the second wave. The real estate sector has been capitalising upon certain positive trends and emerging opportunities. Despite lockdowns, developers have completed some major commercial projects and have put them for possession and lease. This shows the stronger confidence of developers in business opportunities in the new normal.”

Getamber further added, “In premium housing segment, the global uncertainties have led to higher NRI investments in the Indian realty. It is estimated that NRIs have already invested over USD 13 billion in Indian realty in FY 2021. The affordable housing sales have shown strong growth, with figures in the Q4 of FY 2021 almost returning to pre-COVID levels. Additionally, the sector is actively involved in kickstarting under-construction projects because brands that have performed and delivered in the past are seeing positive traction. Added to this, a good off-take of ready to move in properties by end-users is another positive. The realty sector is prepared to combat foreseeable future challenges and it expects to record a strong growth number in the next three quarters, provided there is no third wave. Along with accounting for 6–7% of the Indian GDP, the sector is the second largest employer of skilled and unskilled labour from the economically weaker sections in the country and is a business generator for more than 100,000 MSMEs and ancillary industries providing over 250 items used in the making of a home. Therefore, it’s a major growth driver and a backbone of Indian economy. Overall, the real estate industry will continue to show greater self-reliance, resilience, and agility in overcoming the forthcoming challenges and in building a promising future for the nation and our stakeholders.”

ANNEXURE – 2

Economic Scenario and Availability of Funding

Economic scenario expectations steady, Outlook on credit availability improves

Source: Knight Frank Research

- Key macroeconomic indicators showed an impact of the second COVID wave which was not as damaging as the last wave. For instance, the Manufacturing PMI (Purchasing Managers’ Index) dropped to 50.8 during the second wave in May 2021 whereas during the first wave in May 2020, it had seen a dramatic drop to 30.8.

- 84% of the Q2 2021 survey respondents expect the economic scenario to improve or remain at the present levels for the next six months.

- With respect to credit availability to the real estate sector, the stakeholder outlook remains optimistic in Q2 2021. 46% of the Q2 2021 survey respondents – up from 41% in Q1 2021 – expect the credit situation to improve in the next six months, while 33% expect capital availability to stay at the current levels.

Rajani Sinha, Chief Economist and National Director Research, Knight Frank said, “The second wave of the pandemic, though more debilitating to human life, had relatively muted impact on the economy and the real estate sector. With less stringent lockdown and learnings from the past wave of pandemic, the industry stakeholders were able to better cope with the second wave. This is getting reflected in the optimistic Future Sentiments for the real estate sector. The availability of vaccine has further aided the optimistic outlook for the sector."

ANNEXURE – 3

Office Market Outlook: New Supply, Leasing and Rents

- On the demand front, 40% of the Q2 2021 survey respondents, up from 34% in Q1 2021 expect office space leasing to increase in the next six months.

- In terms of supply, 69% of the Q2 2021 survey respondents were of the opinion that the new office supply will either increase or remain the same over the next six months.

- 21% of the Q2 2021 survey respondents, up from 15% in Q1 2021, expect office rents to increase in the next six months while 40% expect rents to remain stable.

Office market outlook improves

Source: Knight Frank Research

ANNEXURE – 4

Residential Market Outlook: Launches, Sales and Prices

- The residential real estate segment has recorded strong recovery across cities post the onset of the pandemic. Driven by the heightened need for homeownership, residential sales have gained momentum across ticket sizes over the last year. Reflecting this positive performance, stakeholder outlook for the residential real estate segment has been recording a positive outlook since the past few quarters which remained more or less similar in Q2 2021.

- In Q2 2021, 64% of the survey respondents, same as Q1 2021 expect residential sales to increase in the next six months.

- On the supply front, the share of survey respondents with the opinion that launches would either increase or remain at the current levels in the next six months fell from 91% in Q1 2021 to 78% in Q2 2021.

- With regard to residential prices, 47% of the Q2 2021 survey respondents – up from 43% in Q1 2021 – expect prices to remain stable in the next six months, while 45% of Q2 2021 survey respondents believe that prices will increase.

Residential market optimism mellows

Source: Knight Frank Research

Dr. Niranjan Hiranandani, National President, NAREDCO and MD, Hiranandani Group said, “The Future Real Estate Sentiment Index from Knight Frank – FICCI - NAREDCO report divulges several key indicators for the way forward in FY 21-22. The Current Sentiment Index score in Q2 2021 reflects the impact of piecemeal restrictions in April and May followed by easing of curbs in June 2021. The calibrated reopening of economic activities with accelerated inoculation drive has resulted in an upward trajectory of home buying demand and sales in June on back of stability and security it offers during the deep crisis. With pent up demand on festive tailwinds, fiscal impetus in form of stamp duty waiver, unchanged ready reckoner rates, historic low home loan interest rate and deal sweetener by developers cumulatively resulted in demand impetus from domestic as well as NRI home buyers’ segment. The positive sales velocity has resulted in lowering of ready to move inventory by renters turning into the first-time home buyers and existing homeowners upgrading to the larger luxurious apartments to incorporate a new normal lifestyle. This trend will continue to garner sales traction in the following quarters as a safe bet investment portfolio.

Dr. Niranjan further added, “Future of housing remains bullish in lieu of optimistic economic growth, new project launch pipeline, rising GDP, improved core sectors indicators, credit availability to the branded developers, growing employment rate coupled with an attractive investment climate resulting in the positive developer future sentiment score. Outlook for the commercial office market has also been progressive in Q2 2021, for both, leasing, and rentals. The demand for office or dispersed commercial portfolios will expand on the back of consolidation trend and expansion of satellite offices following the hub and spoke model. Value offices near value homes in an integrated township that offers a complete live - work - play lifestyle, helps to reduce carbon footprint, enhance productivity, and increase employee retainability will be an ideal future of work scenario. The remote work near home trend will give fillip to new commercial development in suburban business districts as the city of Mumbai witnesses linear growth towards the rise of suburbia. Thus, the next few quarters should see alignment to the new normal work trend shaping up in the work-sphere.”